Today, Activision CEO Bobby Kotick is leaving his post following a three-decades-long tenure, which has seen everything from the birth of juggernauts like Call of Duty to high-profile allegations of sexual misconduct and discrimination to – most pertinently – a $68.7 billion sale to Microsoft. Kotick is being joined this month by Humam Sakhnini, vice chairman of Blizzard and King, and Lulu Meservey, chief communications officer, in January, with other execs like Activision Blizzard vice chairman Thomas Tippl, chief administrative officer Brian Bulatao, chief people officer Julie Hodges, chief financial officer Armin Zerza, and chief legal officer Grant Dixton departing at the end of March.

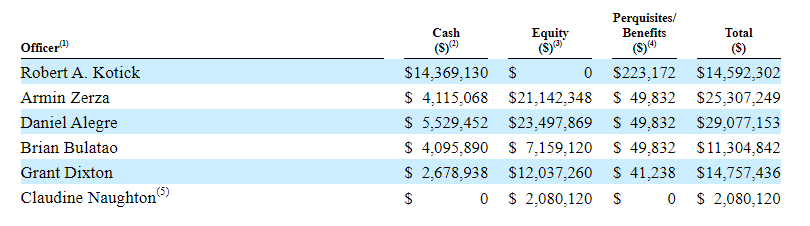

As part of this, Kotick and other execs will receive “golden parachute” payments of, in several cases, over $10 million. Per a 2022 merger proposal that an Activision spokesperson told Aftermath remains up to the date:

Kotick in particular will take home nearly $15 million – less than some of his soon-to-be-ex-colleagues because, according to Activision Blizzard financial statements from 2023 and 2022, Kotick did not have any unvested equity outstanding as of December 31, 2021 or December 31, 2022. Basically, big companies like Activision often compensate executives with restricted stock options, or RSUs, which then “vest” and reach their full value by converting into common stock at a later date. The idea here is to incentivize executives to stick around; if they suddenly leave without a (contractually defined) good reason, they risk forfeiting a great deal of money they theoretically made.

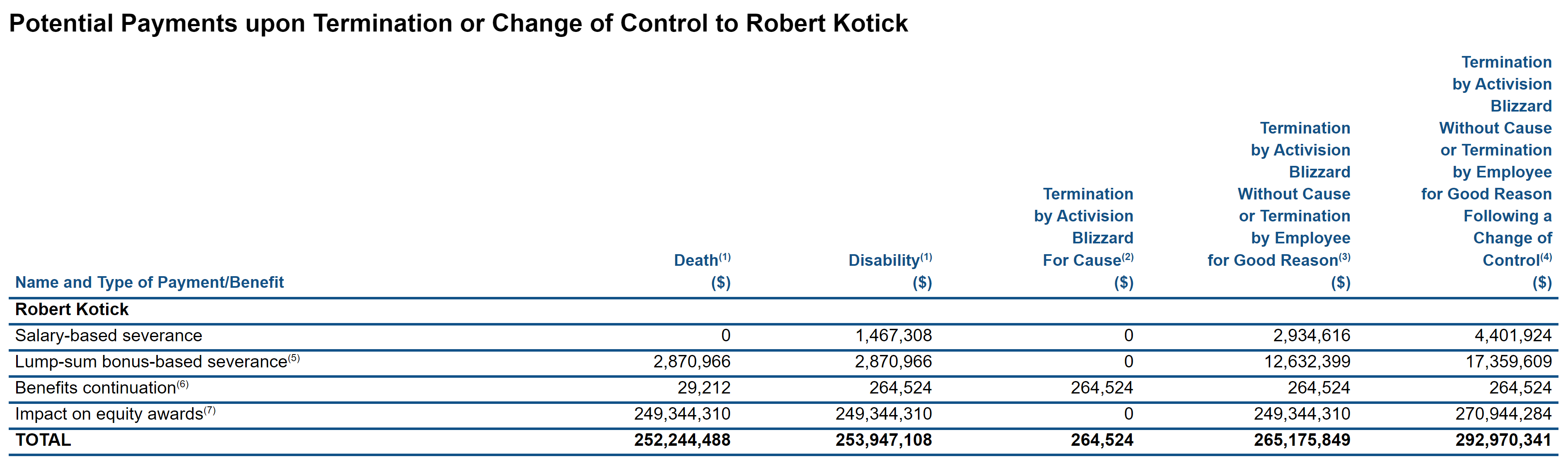

But let’s say somebody like Kotick leaves or is terminated due to a change of ownership, which is exactly what’s happening here. Then other agreements kick in, like the aforementioned golden parachute portion of the merger, which mirrors the termination clause in Kotick’s own contract. If you follow this stuff really closely – like some sort of journalist – you might have seen a table of Kotick’s potential termination pay floating around last year, when it first became apparent that he probably wasn’t long for his Activision Blizzard King-dom.

This table, originally from a 2021 financial statement, included some eye-popping figures: Upon “Termination by Activision Blizzard Without Cause or Termination by Employee for Good Reason Following a Change of Control” – which is a long-winded way of describing what’s now happening at the company – Kotick stood to take home an estimated total of $292,970,341. That, for reference, is nearly enough to fund a big-budget game production like Insomniac’s Spider-Man 2, which reportedly cost $300 million to make.

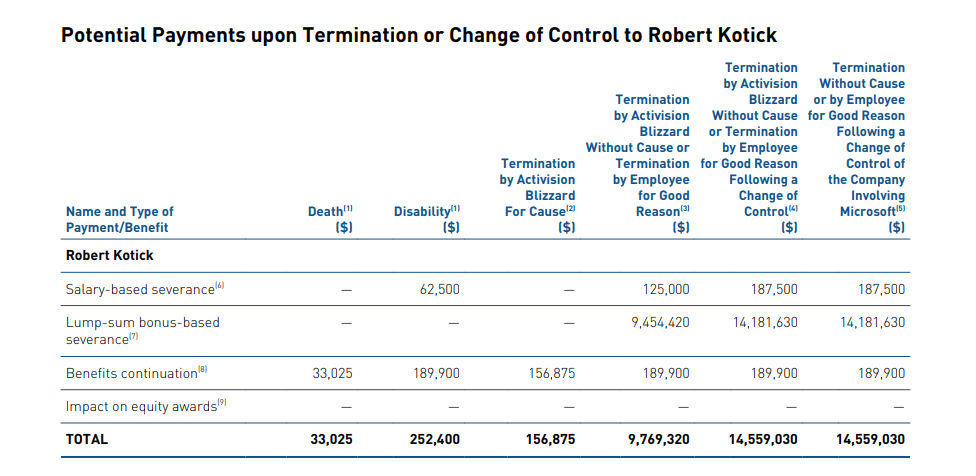

But those numbers were not set in stone. For one, as Odin Law and Media attorney Brandon Huffman told me last year, when that table first made the rounds, it was based on a share price from the end of 2020, which inflated the numbers compared to Activision Blizzard's value in 2022. So let’s look at a more recent version of the same table from an Activision Blizzard financial statement in 2023:

As of June 21, 2023, when the proxy statement was published, Kotick stood to take home $14,559,030 upon termination – significantly less than the hundreds of millions he was looking at in 2021. This is almost certainly because his RSUs vested in the meantime, so he effectively already made all of that money. The statement points out that the "impact on equity awards" section of the table is now blank because Kotick "had no unvested equity outstanding as of December 31, 2022, so there are no amounts attributable to such awards for purposes of this table."

As of earlier this year, Kotick had a total of 4,296,550 shares in Activision, which Microsoft purchased for $95 per share. That means Kotick's total take from the sale was probably over $400 million. He also retained the right to acquire 2,201,878 more shares, but an Activision spokesperson did not reply to Aftermath's inquires as to whether or not Kotick exercised this right.

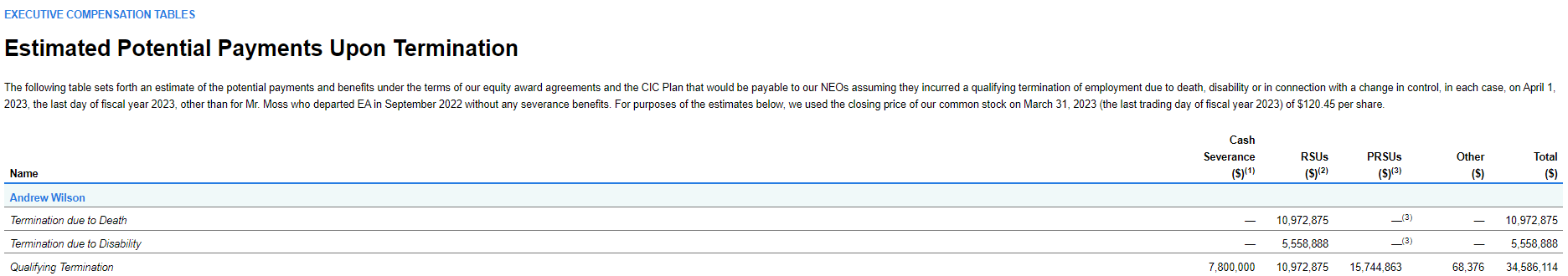

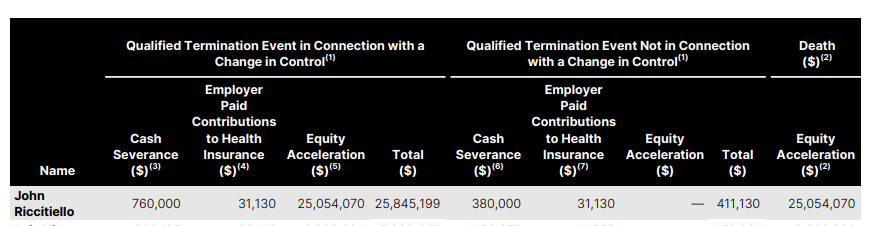

In short, executive contracts often state that when a “change in control” – or a buyout that stands to remove an executive from their position – takes place, outstanding stock units vest immediately. Similar language is present in reference to other video game company CEOs, like Strauss Andrew Wilson at Electronic Arts and, prior to his resignation (RIP), John Riccititello at Unity:

Over at Grand Theft Auto owner Take-Two Interactive, things work a little differently, though the RSU portion of it is still basically the same. This year Zelnick – or rather, Zelnick’s management company, Zelnick Media Corporation, which represents both Zelnick and Take-Two president Karl Slatoff, who split money 60/40 – received $72,350,718 from Take-Two, a whopping $43,806,481 of which came in the form of performance-based RSUs granted in 2022 and another $25,315,742 of which were time-based RSUs granted in 2022. (As part of the filing, Take-Two was required to disclose that annual total compensation of the median employee -- excluding Zelnick -- was $75,276.)

According to a September 2022 SEC filing from Take-Two, RSUs granted in fiscal year 2022 were set to vest on April 13, 2023. But if, somehow, Take-Two were to have changed hands prior to that date (with the deal going through and everything else that entails), Zelnick and Slatoff’s termination totals would have been pretty different, since they would have factored in unvested RSUs.

That said, Zelnick and Slatoff still would’ve made a lot of money either way! Per the terms of their contract, every year their management company gets paid a “management fee” of $3,300,000 in monthly installments. Termination as a result of change in control gives Zelnick Media Corporation the earned but unpaid portion of the management fee, any unpaid bonus for a specific fiscal year, and three times the sum of the annual management fee plus the target bonus amount. That last bit alone adds up to quite a chunk of change: The target bonus amount, according to a recent management agreement between Take-Two and ZMC, is 200 percent of the management fee, or $6,600,000. That plus the management fee is $9,900,000. Multiply that total by three, and you get $29,700,000. Even if you factor in that it’d likely be split 60/40 between Zelnick and Slatoff, Zelnick would still take home $17,820,000 – a few million more than Kotick’s $14,559,030.

According to unofficial estimates, more than 7,000 video game workers were laid off in 2023.